This goes beyond simply knowing how to escape the rat race. This advice I’ve given to people who are lost, unsure what to do in life, unhappy in what they’re doing or even unsatisfied with their earnings. It’s bigger than just an escape because it leads to something much more desirable…which is reclaiming your time.

Managing to escape the rat race and reclaim your time, in my opinion, is the most valuable achievement you can make in your life because, as we’re about to discuss, ‘life’ may not actually be spent living in the most part.

For starters, a third of your ‘life’ is spent sleeping…although admittedly I’m still working on trying to find an effective and healthy way to cut that down.

For most people, if you’re working a typical 9-5 job that’s another third gone…even more when you factor in the time getting ready for work as well as traveling back and forth.

That leaves you with less than a third of your life spent actually doing the things you want to do…provided you actually use 100% of that time doing those things.

Unfortunately, after a day of hard work in your 9-5, more often than not you just want to relax and unwind…which can be nice, but it’s unlikely that relaxing and unwinding are high up on your bucket list.

Depending on what you believe, we only get one life…and when you spend a large chunk of it having to work to pay the bills, trapped in an endless loop, it suddenly becomes a whole lot shorter in real terms.

Escape The Rat Race

This is the definition of the Rat Race as given by Wikipedia:

A rat race is an endless, self-defeating, or pointless pursuit. It conjures up the image of lab rats racing through a maze to get the “cheese” much like society racing to get ahead financially.

The term is commonly associated with an exhausting, repetitive lifestyle that leaves no time for relaxation or enjoyment.

No time for relaxation or enjoyment. An endless, self-defeating or pointless pursuit.

We all know what it is yet most of us simply accept that it’s what we do in life. The way that we go through the school system is set up to program us so that we must go and work our way up a career ladder in 8-hour slogs. A relic that became standardised after the industrial revolution.

As explained by the brilliant Alan Watts in this video, life is a journey that should be enjoyed rather than waiting and building up to a point to then realise you’re too old and tired to start living…

Defining Goals

This is an exercise I regularly do with my friends when they tell me they’re a bit lost. When they aren’t sure what to do in life and feel in a rut.

You need to start at the end and work backwards.

Take a moment to consider what you would be doing with your life if you didn’t have to work. Make a list.

It may be that you absolutely love what you do and would carry on working…or perhaps move to a different line of work if you didn’t have to worry about the earnings. Something you truly enjoy.

Perhaps it’s working on a passion project? Or working on charitable pursuits to better the world…or maybe you’ve really wanted to take time out to write a book for a while.

Perhaps it’s being able to spend more time with friends and family or finally being able to push forward that business idea you’ve been thinking about.

Whatever it is, write it down. As many things that you can think of…

This is your new bucket list.

These are the things that you’ll regret not doing when you’re lying on your death bed.

Nobody will be lying there saying “Oh I wish I’d got those documents on to my boss’ desk.”

Financial Independence

Once you’ve got a clear idea of how your time is going to be best spent…the next step is to figure out a way of actually being able to do it.

It’s quite possible that you are happy in your work. In which case, you don’t need to escape the rat race.

For anybody else that now needs to make a change, you need to figure out how to earn income while you spend your life ticking off (and adding to) your bucket list.

The solution obviously isn’t working in a job, as you need to earn this income without having to exchange your time. That would defeat the whole point…unless, of course, it’s a job that’s on your list…but even then this may not be financially rewarding enough to cover all of your expenses. It’s very rare to find a job that you’re truly passionate about that also pays you what you need/want.

Wikipedia’s definition of Financial Independence:

Financial independence means you have enough wealth to live on without working. Financially independent people have assets that generate income (cash flow) that is at least equal to their expenses. Income you earn without having to work a job is commonly referred to as “passive income”.

What we’re looking for is those last words: “passive income”.

I will add that I don’t believe that any income can truly be regarded as absolutely passive. There’s always some element of time required but it’s certainly possible to get very close, especially once you have the right systems in place.

It Starts With A Surplus

A surplus of cash.

If you’re earning more income than goes out on your expenses then you have a surplus. If it’s the opposite, you have a deficit…in which case this is especially important.

If you don’t have a surplus, you can either try to cut down your expenses or alternatively you could try and increase your income. Both will work, although I would always advocate pushing more to the latter.

While the amount you can cut your expenses is generally very limited (especially without living the bleakest of lives), the amount you can potentially earn is essentially uncapped. Trillions of dollars are exchanged worldwide each day…it’s just a case of routing some of that in your direction through various means.

Whether it’s a bonus, inheritance or an extra shift…this income will all get utilised. The more income achieved, the quicker this entire process will be.

Coming up with creative ideas and pursuits to hustle and grow this pot is not only fun, these skills will help you out later on should you decide to follow entrepreneurial pursuits.

When you have a very specific purpose for raising the cash, you become incredibly driven working towards that goal…as long as your goals are crystal clear, you can break down the steps to achieve them. Start with the end in mind and work backwards.

It’s worth knocking up a vision board with all the items on your bucket list and displaying it somewhere prominent so that you don’t forget. It will keep you focused.

The point here is that we’re going to be using this extra cash and making it work for you to unlock your time by giving you passive income.

Assets vs. Liabilities

So now you’ve started building up a pot with your income surplus and cash injections.

It’s probably sitting in a savings account slowly earning interest. The key word there being…slowly.

In reality, this is actually a form of investment. You’re lending the bank money and they are giving you a return on your money.

This is passive income from an asset.

Important:

- Assets cash-flow into your pocket.

- Liabilities cash-flow out of your pocket.

While your cash is sat in the bank earning you interest, you have an asset…although I go into great detail in this article as to why, with inflation, you’re probably actually losing money in a savings account.

The goal here is to be funneling as much of your cash as possible into acquiring assets, i.e. things that pay you money.

Your cash remains in the asset, which will hopefully increase in value over time…and even better, pay you monthly interest.

Eventually, your assets will pay you enough each month to cover your expenses and this is the cherished point at which you become financially independent.

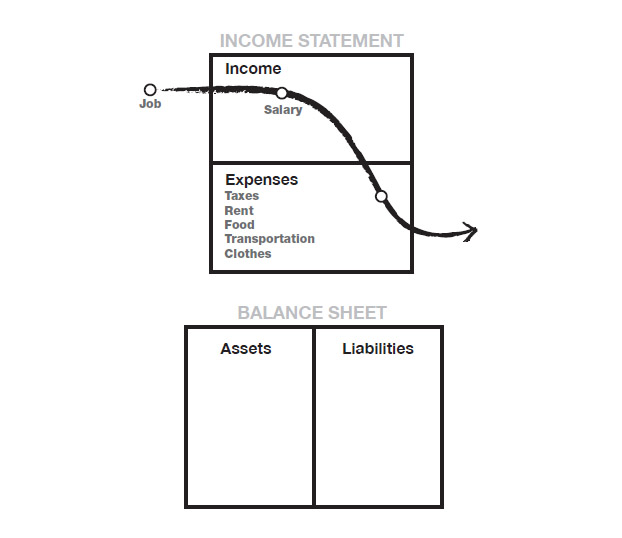

Here is what the flow of cash looks like for most people that have a job:

You can see that the salary goes straight towards paying expenses with nothing left over to invest into assets…and consequently this means that there’s also no income from any assets. Often the expenses are actually higher than the income which typically results in debt.

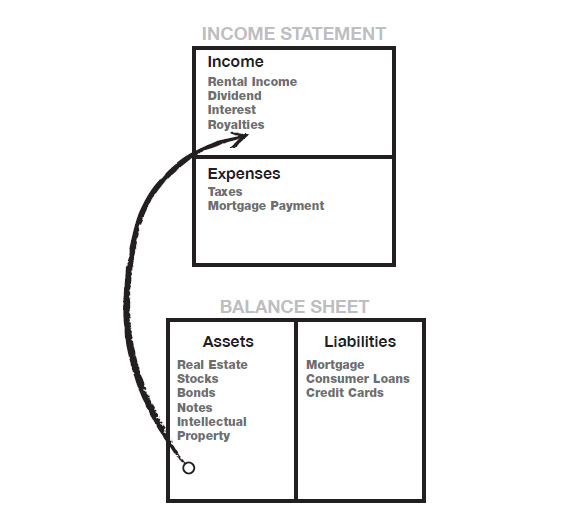

To escape the rat race, this is what you want to be aiming for…

This is how the rich get richer.

As you can see, all of the income is coming from the assets on your balance sheet, which will then go on to pay your expenses.

Job income becomes redundant and not required. At this point, if you want to continue earning a salary from a job, as your expenses are now entirely covered by your assets it would actually be most sensible to put all of those earnings into assets so that your passive income continues to grow even more so.

As another tip, before you reach the financial independence threshold and you’re still earning income from a job, my advice would be to reinvest most, if not all, of the earnings that your assets bring in.

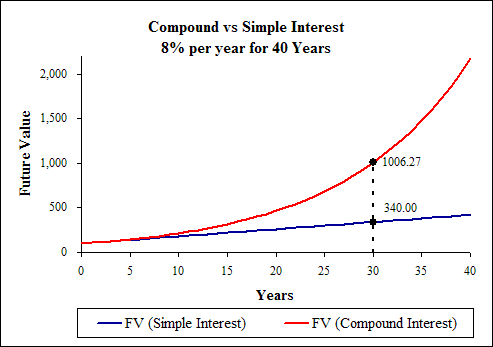

This will allow those earnings to compound.

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. This means that the interest you earn each year is added to your principal, so that the balance doesn’t merely grow, it grows at an exponentially increasing rate.

This shouldn’t stop once you’re financially independent, but it’s especially important to maximise compound growth as much as possible so that your income is replaced as quickly as possible.

The more you have invested in assets, the more interest you can earn…the more you can reinvest and grow. It’s a virtuous cycle.

Is compound interest going to make a huge impact at the beginning of your journey? In reality, that’s unlikely.

For compound interest to be really effective, you need something significant there to compound which you will need to build up…however it’s a good concept to understand and when the first priority is replacing your income, every little helps until that’s achieved.

Choosing Assets

If you look in the asset box on the ideal diagram above, this will give you an initial idea as to potential places that you could invest your money.

There are lots of options, all with varying degrees of risk and return…

- Property Portfolio

- Stocks & Shares

- Business

- Intellectual Property

- Pensions

- Joint Ventures

- Loans

And many, many more.

Until you become financially independent, we know that the goal is to build up consistent, monthly, positive cash-flow.

One of the best ways to achieve this is from rental income. With every investment, you can have a very good idea of the rent you’re likely to achieve, the costs you’re likely to pay and consequently the amount of profit that will likely land in your bank account every month…all while the property value will likely be increasing.

I’ve written a mini-series that gives you a good starting point for a property investing journey…

I would recommend having a read of the following articles which are all complementary and all incredibly important.

- This article goes into more depth on why I believe that property investing is the best way to invest money.

- This article goes into more depth on how to minimise the risks that come with property investing.

- This article goes into more depth on how to work out your return on investment and assess property investment opportunities so that you can start to find some for yourself.

(NOTE: If you want to quickly build up your passive income but don’t have the time or knowledge required, we’ve created an innovative investment strategy that allows lenders like you to benefit from the profits that our expertise generates & immediately start earning a fantastic, hands-free income. Click here to find out more.)

Actions

My hope is that having the freedom to take entrepreneurial chances safe in the knowledge that you are getting paid by your assets will engender a unique atmosphere and a boom in creativity. A growth in entrepreneurship leads to innovation and ultimately prosperity across the board which makes the world a better place.

The key actions that need to start happening to make all of the above possible are:

- If you feel you’ve got any value at all from what I’ve written here or if you know others that would benefit from reading this, please share this article. I’m incredibly passionate about having as many people as possible read this and your help in spreading the word is absolutely invaluable. We’re on a mission to get 1,000,000 people financially independent but we need your help so if you think your friends/followers would benefit from reading this then please do share.

- Start hustling and create a monthly cash surplus if you haven’t got one already and get creative in finding ways to generate lump sums. Try to invest as much of this spare cash as possible into assets. These should be good investments that give you even more positive cash-flow.

- Learn how to find good investments or partner with those that do. A learning phase is absolutely critical before any business or investment venture…but that’s why we are here. Start by reading the above linked articles as they will be incredibly helpful or find out how we can build your passive income for you.

The key thing here is that action is actually taken.

Many people know what they want to achieve yet do nothing about it.

When you see the returns rolling in effortlessly (forever) simply because you made good investment choices, one thing for sure is that you’ll wish you had started sooner…and the sooner you do start, the more your money can compound…and most importantly, the sooner you’ll be able to reclaim your time and live your best life.

…So what are you waiting for?