Knowing how to quickly assess investment opportunities is critical to maximising the use of your time.

If you can weigh up whether an investment opportunity is going to be viable before dedicating too much time to it, you’ll save countless hours in the long-run.

There’s no point delving into the due diligence if the top level numbers don’t stack.

I’m going to walk you through a very quick way to make the call as to whether it’s worth your time or not.

Number Crunching Investment Opportunities

Let’s keep the numbers simple…say a property is worth £100,000.

When we buy an investment property we typically need to put in a 25% deposit, so in this instance it would be £25,000.

This means the mortgage is 75% loan-to-value and consequently £75,000.

If you remember the key rules for risk management, whenever we buy a property we need to make positive cash-flow so we need to understand the costs associated with it.

The main cost we have is the mortgage…and remember, with leverage, the less money you have invested in the project, the better your return on investment, so that’s why we typically use interest-only mortgages and not repayment. You want to be careful not to over-leverage in case the markets turn or interest rates rise dramatically but the maximum loans-to-value set by lenders does a good job helping to maintain that balance.

There are a few rules-of-thumb that you can use to quickly work out what you’d be paying in interest each month.

- For every £20,000 you borrow, interest-only, at 6%, it will cost you £100 per calendar month in interest.

- For every £30,000 you borrow, interest-only, at 4%, it will cost you £100 per calendar month in interest.

This makes life very easy if you need to work it out quickly. Of course, you can just multiply the borrowed amount by the interest rate but if you’re out and about that isn’t always practical.

Using the 4% method will give you a more accurate depiction of what you’ll be paying with interest rates being so low at the moment however it’s best to use the 6% method to be conservative.

Interest rates can only really go in one direction at the moment and that’s upwards.

If the project stacks up at 6% interest then you’re safer…and you’ll make more than you calculate.

So, using that for our example, borrowing £75,000 at 6% would be £375 per month in interest.

You’d take out that mortgage over 20 years or so and the hope would be that after 20 years that property would go up in value and hopefully pay it off.

As explained in this article, it’s not unreasonable to expect that from the market trend.

We’d still owe the £75,000 by the end of it but the property could be worth £300,000 or £400,000.

Costs

The mortgage is the main cost but there are some other ones too.

The mortgage company will send a surveyor round and check the value of the property. They’ll check the value of the rent and assess whether it covers an approximation of the costs.

For this they typically use a multiplier of around 1.45 (which used to only be 1.25) which they multiply with the interest payment to estimate costs. That gives us the minimum required rent…

So, £375 times 1.45 = £543.75.

In reality, the costs will probably be less than this but they like to be conservative when assessing investment opportunities…as should you.

We then look at the actual rent. So, in this case if the rent is £700, it would make money. It would make £156 per month (rounded). In a year that’s £1872 profit.

You might think that that’s not a huge amount of profit and it isn’t – this example is just an average, single-let property and we, personally, don’t buy average properties but it keeps the maths simple.

Taking that one step further, you can now work out the return on investment for this property.

Return On Investment (ROI)

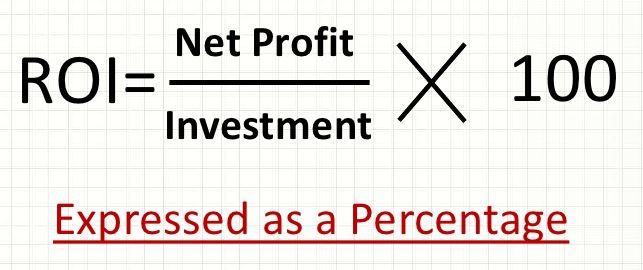

Recognise this formula?:

This is an indicator of how much your investment earns relative to how much you’ve invested. The higher the better when weighing up investment opportunities.

It should be noted that the ‘gross yield’ that an investment produces is worked out by dividing the gross income by the purchase price (as opposed to how much you’ve actually invested, excluding borrowing).

This will give you an easily comparable percentage to show you how valuable an investment is on an annual basis, and you should always aim for high yields…but your ROI is worked out on how much you earn relative to how much you’ve actually invested from your own money. It’s essentially how to weigh up the best use of your cash.

The annual net profit on our deal is £1872 and the initial investment was £25,000. In reality you would include all of the costs like buying, refurb etc. but for this example we are keeping it simple…

(£1872 / £25,000) x 100 = approximately a 7% ROI.

That’s what you get on an annual basis.

As I said, that is an average property and a lot of investors would be very happy with that.

We actually use our knowledge and invest in properties that give us a much higher return on investment…10%, 15% or often upwards of 20% which is a bit healthier and, to increase the number of projects we work on, is why we can afford to bring in other investors to share the profits…but that 7% is still very good compared to what your cash might be earning sitting in the bank.

Is that better than what you’re getting in the bank?

But here’s the real reason people look to property for investment opportunities: it’s the long term growth.

The property, over time, will go up in value. Obviously there’s no guarantee but there’s a good chance that in ten years time the property could double in price.

So, if this one is £100,000 now it could go up to £200,000. That’s an increase in value of £100,000.

Over ten years, if our profit is £100,000 and our initial investment was £25,000 – that’s a ROI of 400%! (Not including rental income.)

THAT is the reason people invest in property.

Would you be happy with a 400% return?

Hopefully now you will be able to quickly assess whether investment opportunities will work for you and whether they’re worth investing more of your precious time into researching them further or moving on to the next one.

(NOTE: Need help crunching the numbers on potential property investment opportunities? We’ve made a handy spreadsheet that does it all for you. Simply input the property details and it’ll do all the calculations. Above all, this is a massive time saver. You can download it for free by clicking here.)