I often get asked the best way to invest money. Invariably I respond by asking a series of key questions which ultimately finish at the same end result but they also crucially help to clarify the journey in the meantime.

In this article I’m going to explain why it’s so important to, at the very least, invest your money rather than ‘save’ it…moreover, I’ll explain why you’d be very smart to make that an investment into property.

Why is property the best way to invest money?

Throughout this section I’m going to ask you several questions.

It’s important to regularly ask yourself these questions as they have the potential to be responsible for not only creating considerable wealth for you but, more importantly, giving you back the most valuable resource that we have: time.

It’s equally as important to understand why these questions are so important…so I’ll dive straight in with the first one. Ask yourself this…

Are you working for your money or is your money working for you?

Do you have a job? Are you paid a salary?

This is the case for the vast majority of people and if it applies to you, then you are working for your money.

The usual scenario is that income comes in, bills get paid and then life gets lived. By the end of the month there’s usually very little left over…if any at all.

However, when there is a surplus (more income than expenses) this has the potential to provide an interesting opportunity.

If that excess money doesn’t just get spent anyway, the likely place that it will end up, most of the time, is in a savings account.

Let’s consider this for a moment…

When you put money in a savings account you earn interest from the bank. You are essentially being a lender and the bank is paying you for the privilege.

That ‘loan’ is earning you money without you doing anything at all.

This is passive income.

Wouldn’t it be great if you earned enough passive income like this to cover all of your bills and living expenses? Yes…yes it would.

The problem with this is that by trying to achieve this simply with savings, you’re going to be trying for a very long time.

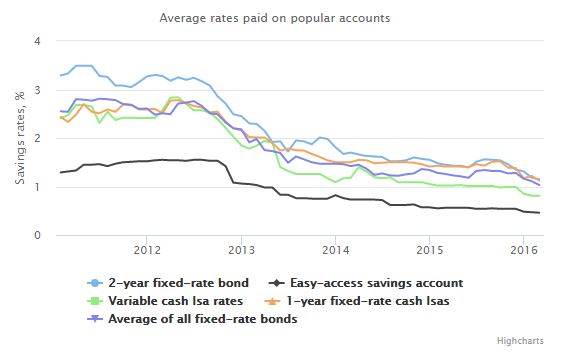

Interest rates from bank accounts, frankly, aren’t great.

You’ll be lucky if you get 1% interest in today’s climate.

This is even worse when you look at inflation…

At the time of writing this, inflation is at 2.4%.

This means that if you have a big pot of cash in a savings account earning you less than 2.4%…you are effectively losing money. This is not the best way to invest money. Far from it.

I speak to people every day who are sitting on small fortunes having been adding to their savings for years yet totally unaware that their “savings” account is actually doing the opposite of what it is supposed to.

So if bank accounts aren’t the answer then what is? This leads me on to my next question…

How well is your money working for you?

If it’s in a bank account…it probably isn’t working for you at all, as we’ve now discovered.

The obvious solution to this problem is to get a higher interest rate, right? Right.

That way you can still receive your passive income but this time it’ll actually make you some more money.

You need to invest your pot of cash into something that will provide consistent returns…and we call these assets.

In simple terms, an asset is something that you purchase that increases in value and/or makes you money and, on the flip side, it should be noted that something that decreases in value and costs you money is known as a liability.

If you manage to get the income from your assets to cover all of your expenses, you can wave bye-bye to that job of yours (if you want to).

You could invest in stocks and shares, property or even a loan like above. All of these could make you money or lose you money. There are risks with every investment and you shouldn’t forget that – and that’s why you need to have the right knowledge prior to investing in anything.

The best way to invest money will utilise: Leverage

If you want the best way to invest money, you need to know how to pick your investments wisely.

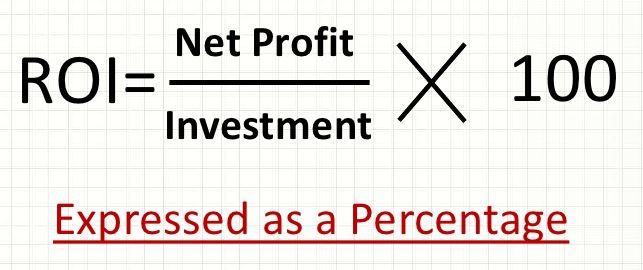

It’s all about crunching numbers, carrying out due diligence and maximising what is known as your ‘return on investment’ or ROI.

This is an indicator of how much your investment earns relative to how much you’ve invested. The higher the better.

Very simply, if you’ve invested £100,000 into something and that money earns you £5,000 in a year, you’ve made an ROI of 5%.

It should be noted that the ‘gross yield’ that an investment produces is worked out by dividing the profit by the purchase price (as opposed to how much you’ve actually invested, excluding borrowing).

This will tell you how profitable an investment is, and you should always aim for high yields. In this instance, the gross yield is exactly the same as the ROI as you’ve purchased for £100,000 and made £5,000…but here’s where things get interesting.

Now we’ve got to the heart of this topic and why I’m such a big advocate of the UK property market as a source of investments. There are several factors that make me feel this way, the first of which being Leverage.

Let’s hypothesise that you do, in fact, have the £100,000 mentioned above and you’re looking to invest.

Let’s imagine that you invested that money into various stocks & shares. Sensibly, you diversified your portfolio and after a year, that money had earned you 5%.

(I’m not saying these figures are representative of reality, these are all purely hypothetical.)

In that year, you would have earned £5,000 on your money. Not bad at all, right?

Let’s compare that to a property investment…and let’s keep the numbers simple and say that you’ve invested your £100,000 into property and prices grow 5% in a year.

At first glance, it may seem that you’ve earned the same £5,000 but in reality, unless you’ve just purchased a £100,000 property outright…this isn’t the case.

Generally when investing in property, you don’t just buy an investment property outright. That would significantly affect your ROI as you’d have to invest so much into that project.

There is no other type of investment where you can use leverage to the extent that you can in property investing…and this is thanks to mortgages.

At the moment, when you purchase an investment property, you typically put down a 25% deposit and get a mortgage for the remaining 75% of the value of the property.

To put that another way, for every £1 of your pot of cash that you invest, the bank/lender will pay £3 towards it.

You still own 100% of the investment…you’re just getting it for a quarter of the price, which also means you own 100% of the capital growth (the amount that the value increases)…before tax, of course.

So, if you are investing your £100,000 in property, and to keep things simple for the sake of this example and ignore purchasing costs, you could actually buy four £100,000 houses by putting four £25,000 deposits down and getting four £75,000 mortgages.

This means you then actually own £400,000 worth of property…and if you earn 5% on your portfolio, you’ve made yourself £20,000…rather than the £5,000 in the previous example.

And that isn’t a 5% return on investment either. That’s just how much the property prices grew.

Because you invested £100,000 and you made £20,000…that’s a 20% ROI! A bit better than the 1% you were getting in the bank, isn’t it?

This is leverage and it is incredibly powerful.

Like all investment strategies, it comes with its risks, of course…but if you know what you’re doing (or working with somebody that does) you can put things in place to minimise those.

Market Growth

Property prices grow or shrink based on supply and demand. In fact, the value of anything is based on supply and demand.

In times of high demand, prices go up and in times of low demand, they go down.

We live on a relatively small island in the UK. We have a finite amount of land and an ever increasing population.

Except in times of financial trouble, like the 2008 credit crunch, demand is always present and consequently property prices will continue to grow.

In fact, on average in the UK, house prices double every nine years.

Let me repeat that: house prices double every nine years on average.

It should be noted that this figure is just an average and is the general trend. There are naturally times when prices can fall over extended periods but the point remains the same. The general trend is consistently upwards and is yet another reason why investing in property is fantastic.

Of course, that’s just the capital growth over the long-term.

And while there are lots of things you can do to boost the capital growth, such as refurbishments and developments etc. there are more ways of making money from property in the meantime.

Rental Income

Yes, don’t forget this! This is absolutely critical to a safe property investment.

It takes a while for property prices to grow…although that is where you’ll really make your wealth eventually.

The rest of the time, each property investment should be working not only as an asset that grows in value, but also one that pays you regularly.

This is how you’ll replace your salary…”cash-flow is king”, after all.

An investment property is like a mini-business.

You can work out exactly how much you will receive in rent each month and you can work out your costs for the privilege.

It’s easy to get great returns simply from the cash-flow from rent alone…then when you eventually take into account capital growth, you’re earning twice!

(NOTE: Need help crunching the numbers on potential property investment opportunities? We’ve made a handy spreadsheet that does it all for you. Simply input the property details and it’ll do all the calculations. Above all, this is a massive time saver. You can download it for free by clicking here.)

What’s important for you right now?

Before you start investing in property, this is an important question to answer.

There are many different types of property investment that can achieve different things. The answer to the original question is relative. The best way to invest money completely depends on your own goals at this moment in time.

Some people are interested in quickly building up that pot of cash through developments, which is a great way of doing things, while some prefer more of a balance with cash flow.

For most people, though, they’re looking for that asset that pays them a monthly income to replace their salary.

Achieving that doesn’t just give you income, it gives you time. The most valuable and finite resource there is.

The fantastic thing about property is that it’s simple to achieve these goals if you spend the time learning how to do it or working with people that already know what they’re doing (leverage – yes, leverage can be used with other people’s time or knowledge…not just money. Learn to master that and you’ll be incredibly successful).

Whether working on your own or with somebody else, it’s vital to have a solid understanding of what you’re doing and how to minimise risks but hopefully now you have a good idea of why, in my opinion, property is the best way to invest money.